Portfolio Management

A process to allocate limited resources among multiple opportunities to create the highest value.

What is Portfolio Management?

A process to allocate limited resources among multiple opportunities to create the highest value.

Key Elements

- Strategy translation and alignment

- Evaluation and selection

- Prioritization

- Resource (money and people) allocation

- Tracking and monitoring

Where is Portfolio Management used?

- Corporate - Enterprise Portfolio

- Business Units - Investments & Assets Portfolios

- Technology - R&D Programs Portfolio

- Capital Projects - Business Unit Level Portfolio - Manufacturing Site Level Portfolio

Portfolio Management Objectives

Strategic Alignment

- Portfolio investments are aligned with the overall Business Strategy to truly enable strategic intent & direction

Portfolio investments achieve a balance across multiple dimensions

- Run/grow/transform

- Long-term vs. short-term

- High-risk vs. low-risk, Risk vs. reward

Maximum return

- The portfolio optimizes use of limited resources to increase value

There are several analytical approaches used to define the potential portfolio. A couple of the most common ones are shown below

Whale Curve

- Set Preliminary Portfolio by analyzing the value to cost efficiency for each project and comparing the cumulative value and cost to the available resource

Risk vs Return

- Assesses the overall risk/return profile for the portfolio for each of the the portfolio components

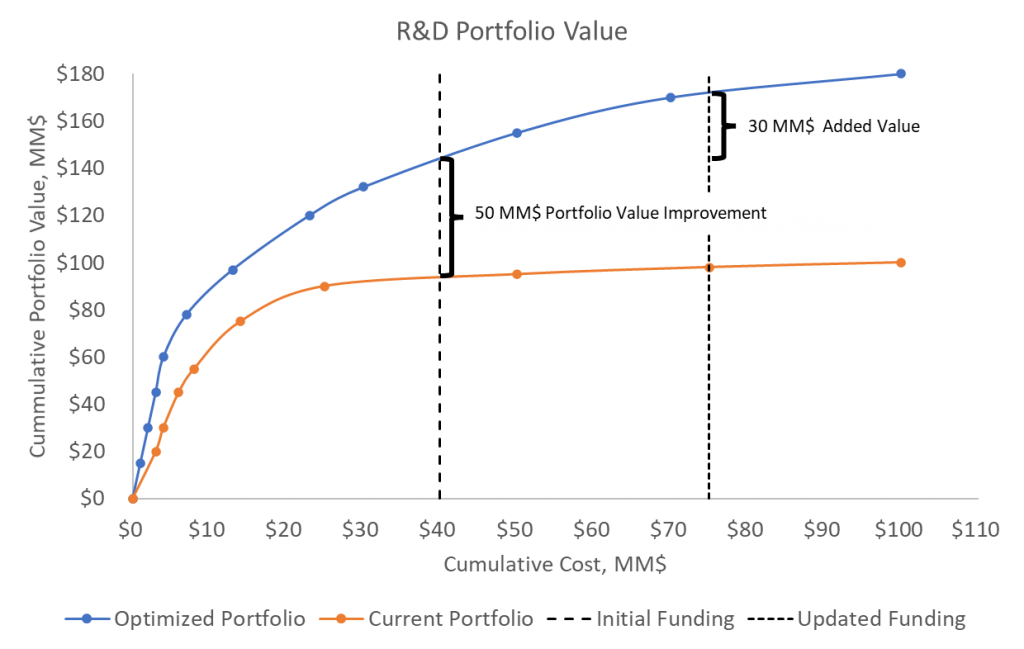

Whale Curve Analysis

An existing R&D program had a 90 MM$ value a set of projects with a total R&D cost of 40 MM$ Applying Portfolio Management approach, the portfolio value increased by 50MM$ to 140MM$ at the same 40 MM$ R&D Cost Consideration was given to potentially to increase the availability of R&D funds to 75 M$ resulting in an incremental value increase of 30 MM$ for a total portfolio value of 170 MM$

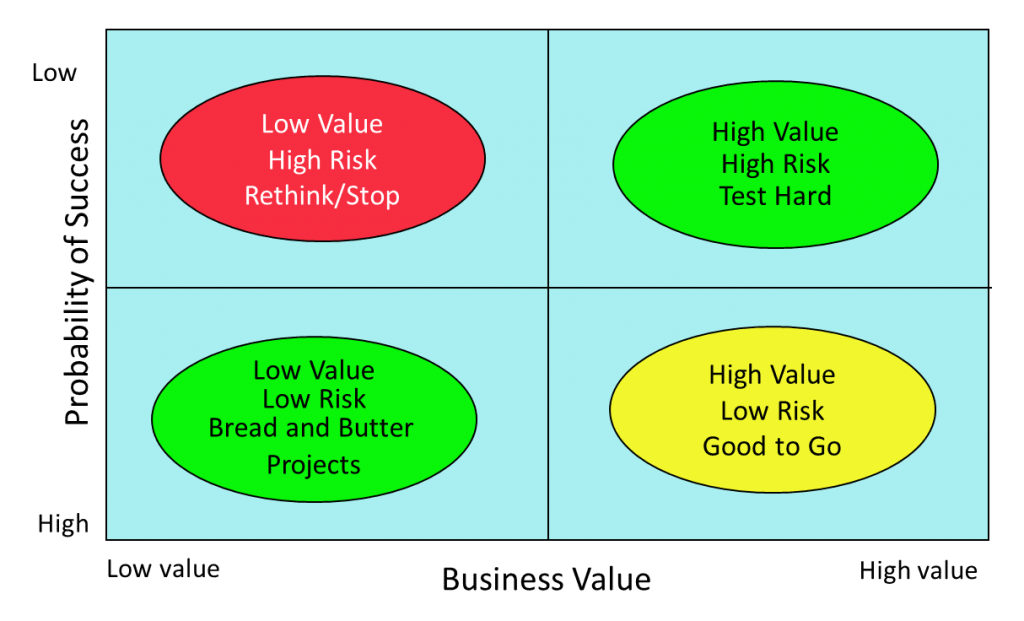

Risk/Reward Analysis to balance the portfolio

Each individual potential portfolio project from the Whale Curve analysis is assessed on the probability of technical and commercial success compared to the value and place in one of these quadrants

- Low Risk/Low Value

- Low Risk/High Value

- High Risk/Low Value

- High Risk/High Value

CONTACT US